In need of professional, easy-to-use and efficient lending software within Sage Evolution?

The Loan Management System (LMS) gives you complete control of your lending products

– LMS is an add-on system for Sage Evolution, allowing you to capture, maintain and track your company’s borrowing and lending in a dynamic and easy-to-operate environment.

Do you engage in covered bond issuance and trading? Are you looking to facilitate your receivables trading processes?

– LMS has the answer for you!

Key features

– Store and track key information

Capturing of information used for calculations or reports (e.g. name of loan, agreement date etc.).

– Interest calculation options

Select for each loan whether the interest is subject to a fixed interest rate, simple or compounded, and the applicable day-count convention to be used in the calculations.

– Automation of transactions

Creation of the calculated interest transactions is automated – There is no need for you to remember to carry them out (at particular times) and type individual line entries separately.

– Posting and integration with Sage Pastel Evolution

In order to use LMS, you must have Sage Evolution. However, transactions in LMS do not need to be posted to Evolution. At any time you can post and check the loan record. LMS marks and keeps track of all transactions in the loan record and provides a detailed report on it.

– Multicurrency

Unlimited foreign currencies can be set up. The LMS home currency corresponds to the Evolution home currency.

Benefits

We understand that every business is unique. This is why in addition to the already-extensive functionality of LMS, we are positioned to build in any additional requirements, specific to your business.

Additional features

– Assignment of loans

LMS automatically closes down old loans and creates new ones when another party is taking over the loan received/given (or 2 new loans when LMS acts as the middleman between two parties).

– Database comparison for group companies

The relevant databases can be linked when maintaining loans for multiple companies.

– Data protection and security

Multi-password protected users (groups)/control access.

– Document storage

Storing and saving documents independently or linked to loan records, with a possibility for downloading later on.

– Reports

Detailed information about each loan (all data required for financial statements in home and foreign currency) is integrated into flexible, clear and comprehensive reports.

– Customizability

Customizable grids and layouts/skins are available within the software.

– Flexible search options

The loan grids contain all information fields on all loans. Users can create filters, and sort and group on any available field.

Add-on Modules

– Direct debit processing

LMS allows you to easily process direct debits, directly through the software.

– Notification runs

Schedule and send out notifications to borrowers and lenders with just a few clicks, using customizable emails and reports.

– Task lists

LMS allows you to organize and keep track of your loan-related to-do list directly in the software. The module enables you to link tasks and sub-tasks to each loan, to set notifications and to manage assignees and levels of completion.

– Additional fees and deals

Pool multiple loans into a single deal. Set additional fixed or variable fees per loan or per deal and let LMS do the rest. – LMS will provide you with facilitated loan pool, fee and waterfall transaction management.

– Sub-transactions

Sub-transactions per loan can be set and managed directly in LMS.

– Receivables portfolios and covered bonds management

Managing your receivables portfolio has never been easier.

By making use of the additional LMS modules available, you can take advantage of advanced functionalities for managing your covered bonds and receivables portfolios. LMS allows for asset tests and facilitated portfolio purchases, sales and interest calculations, administered directly in the software. Key information is stored per asset, with additional functionalities for foreign currency revaluations, and asset and payment transaction imports.

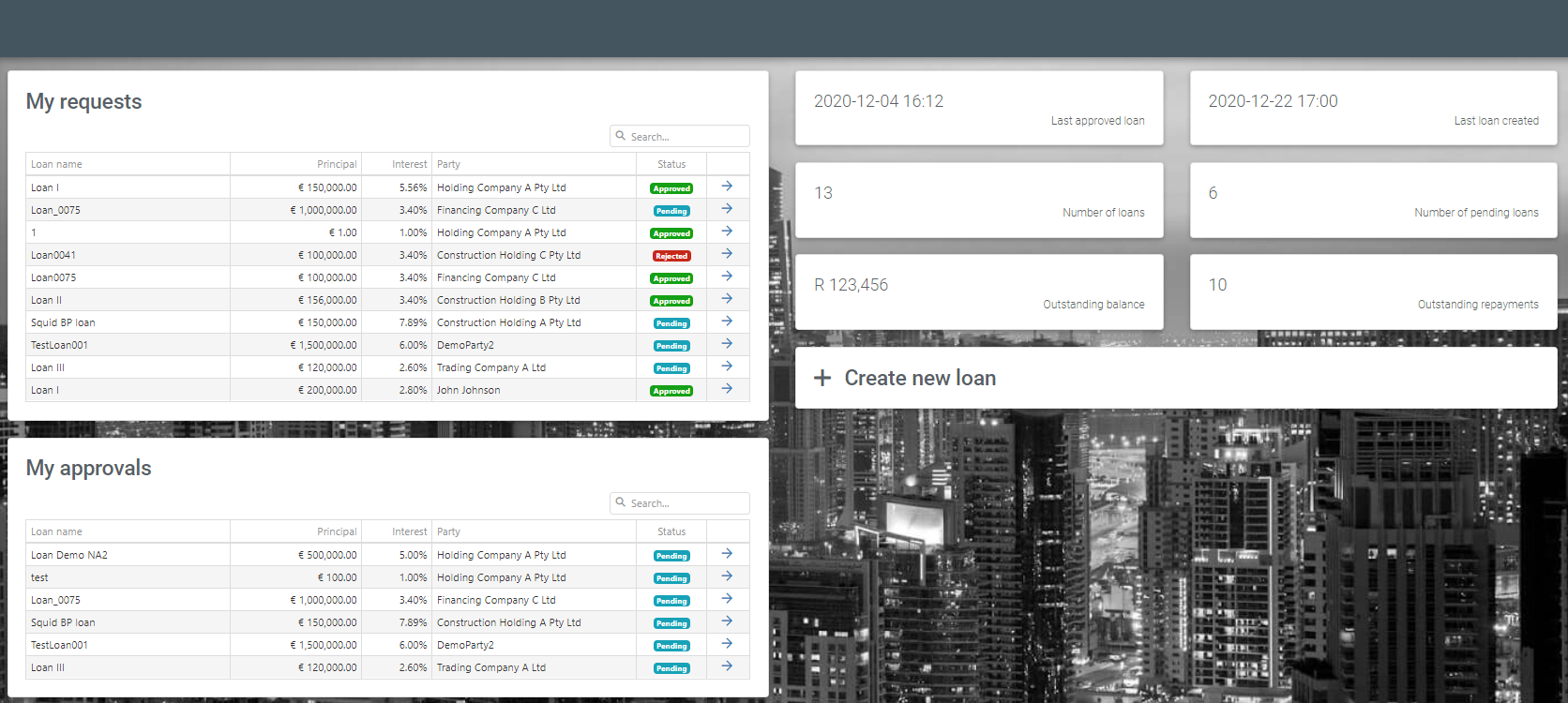

LMS Online

Accelerate your loan management with a web-based tool (Asamco Platform): Combine multiple web applications in one platform, with a single sign-on and easy management of your business processes.

Why go Online?

- Single sign-on to all business applications

- Worldwide access to all relevant information at any point in time!

- Management of loan master-data

- Loan creation – Allow (external) parties to create loans after completing a customizable prerequisites checklist and submit the new loans for approval.

- Workflow to approve before loans are created!

- Loan transaction import – Manage bulk-import of loan transactions (especially for parties acting as a loan servicing agent), all with convenient web-based approvals.

- Web API availability

- Combine with the Reporting module for extensive (self-creation) of business intelligence reports!

Are you ready to take absolute control over your loans, receivables and financial structures?